Most of the TurtleSoft office is now boxed up and in a storage unit.

The original moving plan was to sell my house, buy another, get settled in, then move the office in one trip. The dance studio downstairs makes this office pretty much useless, so it’s happening in reverse order instead. Not ideal, but necessary.

My house went on the market a few weeks ago. It sold quickly, at an attractive price. Closing is in mid-May.

Two years ago I tried a for sale by owner. It went well. Using an agent netted a similar price, if you subtract commission, adjust for two years of appreciation, and add the improvements made since then. Unfortunately, this time around there just wasn’t time to pack up and give tours, all at the same time.

In 2021, the problem was finding a house to buy: a fixer-upper, but not too far gone. Real estate was in turmoil because of Covid-19, so I decided to wait. It’s even worse now. People don’t want to trade their cheap mortgage for a heftier one, which makes listings scarce.

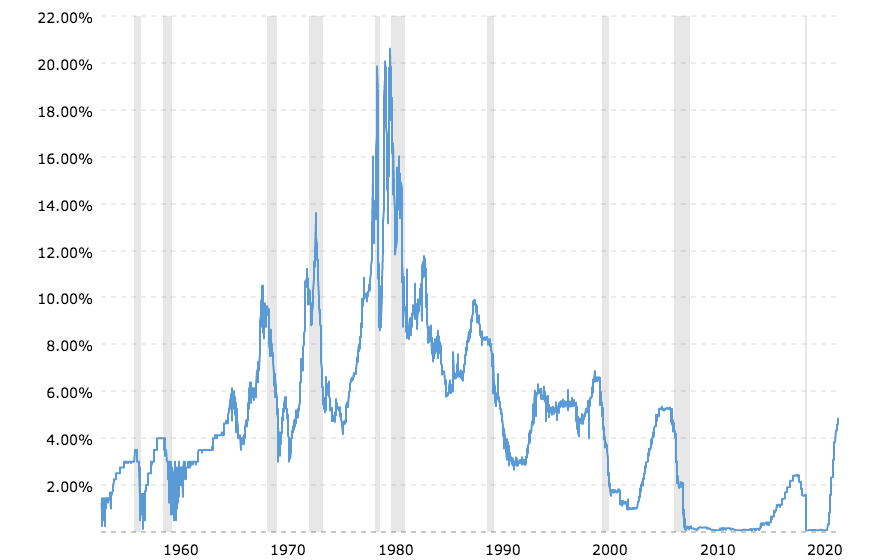

Something similar happened when selling my first house in 1980, but much more extreme. Mortgage rates were in the teens and higher. It froze up most house sales. On the plus side, money market accounts gave 20% interest, so waiting was very lucrative. It was an odd spell of US economic history that makes the current spike seem puny.

Hopefully the transition will be easier, this time around. Once there’s a stable home, our staff will return to productive programming again. Worst case, it will be in a rented apartment somewhere.

Dennis Kolva

Programming Director

TurtleSoft.com